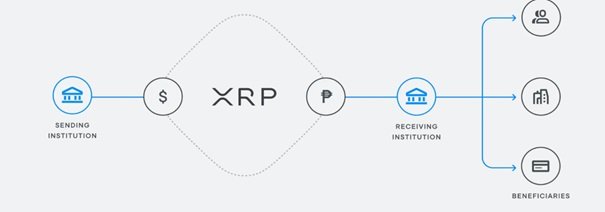

Ripple is a cross-border payment system . Ripple was created to provide fast and low-cost money transfers between financial institutions . It works using blockchain technology instead of the traditional SWIFT (Society for Worldwide Interbank Financial Telecommunication) system .

Ripple’ s main goal is to make global money transfers faster, safer and cheaper. Cryptocurrency called XRP is used in the system . XRP is used to process transactions and provide liquidity in the network .

How does the system work ?

Banks or financial institutions in the Ripple network can store their XRP amounts in a common pool called the “XRP Liquidity Pool” . In this way, instead of directly exchanging foreign currency , they can instantly trade with XRP , which speeds up processes and reduces costs .

Ripple also offers a product called “xCurrent” – which allows banks to monitor and manage cross-border payments in real time . In addition, another product called ” xRapid ” aims to increase the efficiency of cross-border payments while helping to solve the liquidity problem of financial institutions .

Which financial institutions has Ripple formed strategic agreements with on cross-border deals.

Which financial institutions has Ripple formed strategic agreements with on cross-border deals.

SBI Holdings, Monetary Authority of Saudi Arabia (SAMA), Banco Santander, Western Union, UAE Exchange and American Express

Ripple has formed strategic partnerships with many financial institutions . Here are some examples :

- Santander : Santander has started to use blockchain technology in cross-border payments by collaborating with Ripple . Through this partnership , Santander aims to offer its customers faster and lower cost international money transfers .

2.American Express : American Express has worked with Ripple to conduct pilot projects to explore the potential of blockchain technology for cross-border payments .

- Standard Chartered: Standard Chartered Bank aims to increase the efficiency of money transfers from Asia to Africa using XRP by joining the Ripple network .

- PNC Bank: PNC Bank also collaborated with Ripple and worked on XRP-based solutions .

- MoneyGram: MoneyGram International Inc. signed a strategic partnership agreement with Ripple in 2019 . Thanks to this agreement , MoneyGram aims to optimize money transfer processes around the world and perform them faster and more cost-effectively .

These are just some examples and it is important to note that Ripple also collaborates with many other financial institutions. Strategic partnerships are part of Ripple’ s efforts to increase its effectiveness in cross-border payments .

Venkat ES , Head of Treasury Products at Bank of America, said that Ripple’s growth in the Asia Pacific region is a remarkable development and has the potential to dominate the payments industry in the future .