Introduction to the Financial Boom in Cryptocurrency

In the wake of the recent United States election, the financial landscape of the cryptocurrency world has undergone a remarkable transformation. A report from Coindesk highlights the significant wealth increase experienced by prominent figures in the crypto industry. This economic shift has reverberated throughout the sector, affecting company valuations and personal fortunes alike.

Brian Armstrong’s Financial Success with Coinbase

Brian Armstrong, CEO of Coinbase, is among those who witnessed substantial financial gains following the election results. Armstrong’s strategic decisions, including stock sales, have led to an additional $129 million in earnings. This financial maneuvering coincides with a dramatic $21 billion increase in Coinbase’s market value. Consequently, Armstrong’s stake in the company appreciated by nearly $2 billion, culminating in a total valuation of $6.4 billion.

Coinbase has also played an active role in political contributions, allocating $74 million to various political action committees (PACs) to support the election. Armstrong’s diversification strategy, which involved these stock sales, ensures his continued control over the company while reaping the benefits of a surging market.

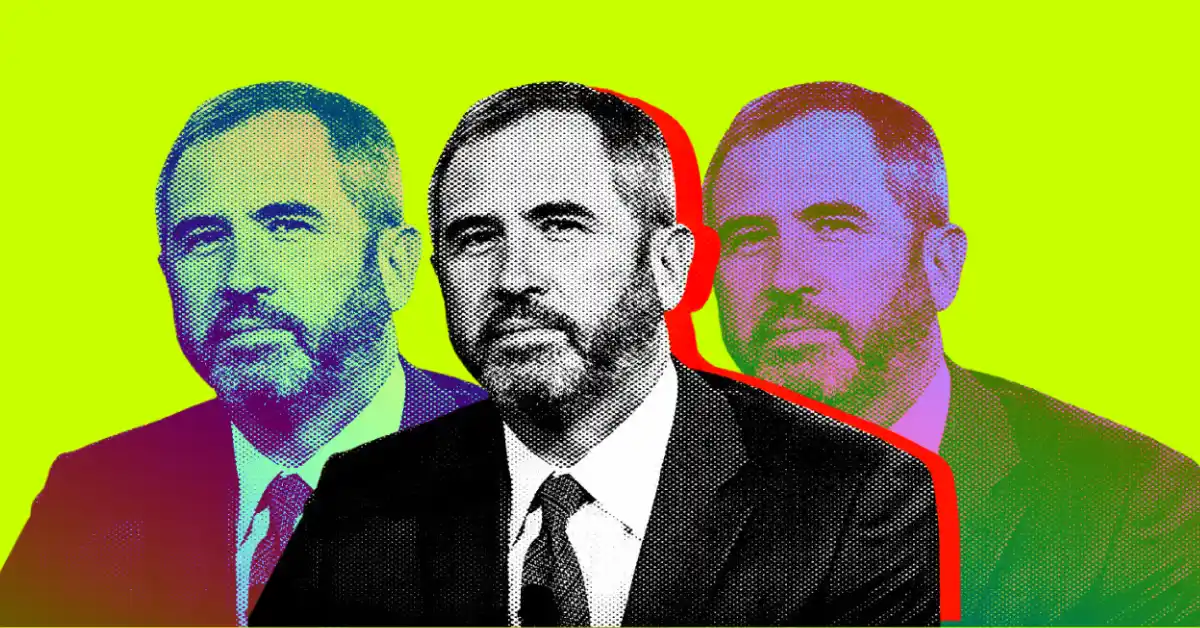

Ripple’s Meteoric Rise and Garlinghouse’s Gains

Brad Garlinghouse, CEO of Ripple, has also been a beneficiary of the post-election economic upswing. The value of XRP, Ripple’s native token, experienced a staggering increase, soaring from $0.50 to $2.32. This significant rise resulted in a 54.7% boost in XRP’s market capitalization over the past 30 days, positioning it as the third-largest digital asset.

Garlinghouse’s ownership stake in Ripple, amounting to more than 6%, along with a substantial share of XRP, has seen its value triple since the election. These developments have substantially increased Garlinghouse’s personal wealth, reflecting Ripple’s growing market presence.

Market Reactions and Future Implications

The broader cryptocurrency market has experienced an astounding increase, surpassing $1 trillion since the election. This growth reflects the collective optimism and strategic positioning within the industry. Garlinghouse aptly remarked on the situation, highlighting the market’s resilience despite regulatory pressures.

Although Ripple Labs’ private valuation was last estimated at around $11 billion earlier this year, the election outcomes are likely to have enhanced the company’s value further, contributing to Garlinghouse’s expanding wealth.

Investment Trends and Political Contributions

Major investors in the crypto realm, including Andreessen Horowitz (A16Z), have also realized significant gains, outpacing their election-related investments. Both Ripple and A16Z demonstrated their commitment to political causes, with substantial donations of $73 million and $70 million, respectively. These contributions underscore the intertwined nature of politics and financial strategies in the rapidly evolving cryptocurrency sector.