Cryptocurrency Leaders See Significant Wealth Surge Post-Election

Introduction

The recent U.S. election has not only reshaped the political landscape but also brought a substantial financial uplift to key figures in the cryptocurrency world. According to a report by Coindesk, several CEOs and investors within the crypto sphere have experienced remarkable increases in their wealth following the election results.

Brian Armstrong and Coinbase’s Financial Triumph

One of the most notable beneficiaries of this financial surge is Brian Armstrong, the CEO of Coinbase. Armstrong’s financial portfolio expanded significantly, with an additional $129 million gained from stock sales. The market value of Coinbase itself saw a dramatic increase, rising by $21 billion. Consequently, Armstrong’s stake in the company grew by nearly $2 billion, elevating its total worth to an impressive $6.4 billion.

Strategic Moves and Political Contributions

Coinbase’s strategic actions during this period included a substantial political contribution amounting to $74 million. These funds were directed towards various political action committees (PACs) to support the election. Armstrong’s decision to sell stocks was part of a diversification strategy, aimed at maintaining his control over the company while strategically managing his assets.

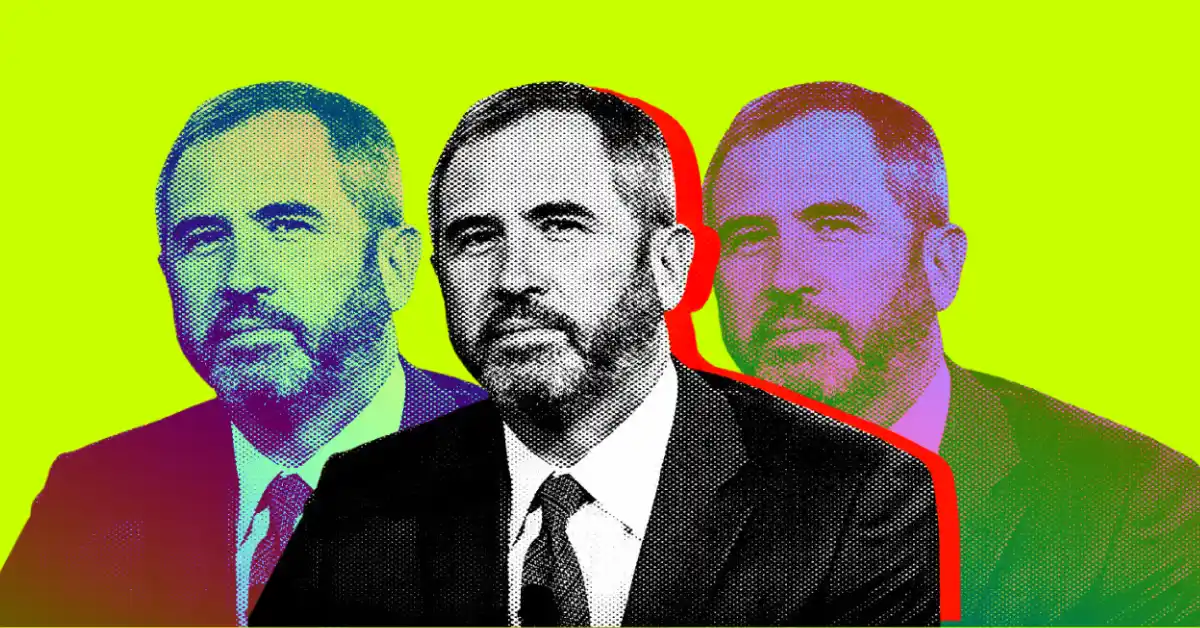

Ripple’s Brad Garlinghouse: A Story of Dramatic Gains

Brad Garlinghouse, the CEO of Ripple, witnessed even more substantial financial gains. The value of XRP, Ripple’s native token, experienced a meteoric rise from $0.50 to $2.32 following the election. This surge resulted in a 54.7% increase in its market capitalization over the past month, propelling XRP to the third position among all digital assets.

Personal Wealth and Market Dynamics

Garlinghouse, who holds over 6% of Ripple and a considerable amount of XRP, saw his personal wealth triple in value since the election. He commented on the market dynamics, stating, "The crypto market is up over $1 trillion since Trump won — that’s the price of Gensler’s foot on the neck of the market, and he’s not even officially gone yet."

Ripple Labs’ private valuation was last estimated at around $11 billion earlier this year. The recent election has likely bolstered the value of Garlinghouse’s stake, significantly increasing his personal fortune.

The Role of Major Investors

In addition to individual CEOs, major investors in cryptocurrency firms have also reaped substantial benefits. Andreessen Horowitz (A16Z), a prominent venture capital firm, reported significant gains that exceeded their election-related investments. Ripple and A16Z both made substantial contributions to political causes, with Ripple donating $73 million and A16Z contributing $70 million.

Conclusion

The interplay between the U.S. election and the cryptocurrency market has led to a financial windfall for key figures and investors. The strategic moves and market dynamics have not only increased personal wealth but have also influenced the broader economic landscape. As the crypto market continues to evolve, the impact of political events on financial markets remains a critical area of interest and opportunity for investors and stakeholders alike.