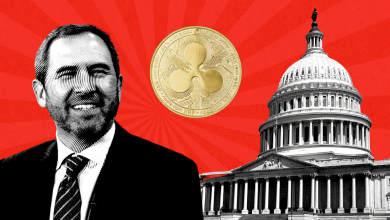

In a remarkable turn of events, the recent triumph of pro-cryptocurrency candidates in the United States Senate, House of Representatives, and the presidency has injected a fresh wave of optimism into the cryptocurrency markets. The newfound political support has catalyzed a bullish momentum for Bitcoin (BTC), significantly reshaping the dynamics of the cryptocurrency market landscape.

Surge in Cryptocurrency Market Capitalization

Over the past 24 hours, the total cryptocurrency market capitalization has experienced a notable increase of approximately 2.2%, reaching around $2.66 trillion as of Thursday, November 7, during the early Asian trading session. This growth highlights the market’s positive response to the evolving political climate and the anticipated policies favoring digital currencies.

Bitcoin’s New All-Time High Amidst Anticipation

Amid the buzz surrounding the upcoming Federal Open Market Committee (FOMC) data release, Bitcoin price soared to a new all-time high of approximately $76,243 earlier today. However, it experienced a slight pullback to $75,386 at the time of this report. This fluctuation underscores the volatile yet promising nature of the cryptocurrency market as investors eagerly anticipate regulatory clarity and potential adoption initiatives.

Analyst Projections for Bitcoin’s Future Performance

In a recent analysis, renowned crypto analyst Ali Charts highlighted a historical trend in Bitcoin’s market behavior. Historically, Bitcoin has shown a tendency to peak approximately 8 to 12 months after surpassing its previous all-time high on a monthly closing basis. This pattern suggests that, following a new monthly close above its previous record high, Bitcoin typically rallies for several months before reaching a new market peak. If this historical pattern holds true, the next significant peak for Bitcoin could be anticipated between July and November 2025.

Supporting this optimistic outlook, seasoned trader Peter Brandt predicts an explosive rally in Bitcoin’s price, potentially reaching a cycle top between $130k and $150k by August or September. Additionally, technical indicators such as the weekly and monthly Relative Strength Index (RSI) are approaching levels beyond 70, signaling that bullish momentum is gaining strength.

The Golden Age of Cryptocurrency

Matt Hougan, Chief Investment Officer at Bitwise, envisions a promising future for the cryptocurrency market, coining it the “golden age” characterized by increased cash inflows, widespread adoption, and a robust bull market lasting for years to come. A significant development anticipated in this era is the potential establishment of a strategic Bitcoin reserve in the United States, projected to amount to 1 million coins. This move would not only solidify Bitcoin’s status as a mainstream asset but also reinforce the nation’s commitment to embracing the burgeoning digital economy.

The confluence of favorable political developments and positive market sentiment heralds an exciting era for Bitcoin and the broader cryptocurrency market. As investors and analysts closely monitor these trends, the future looks promising for digital assets, offering new opportunities and challenges in equal measure.