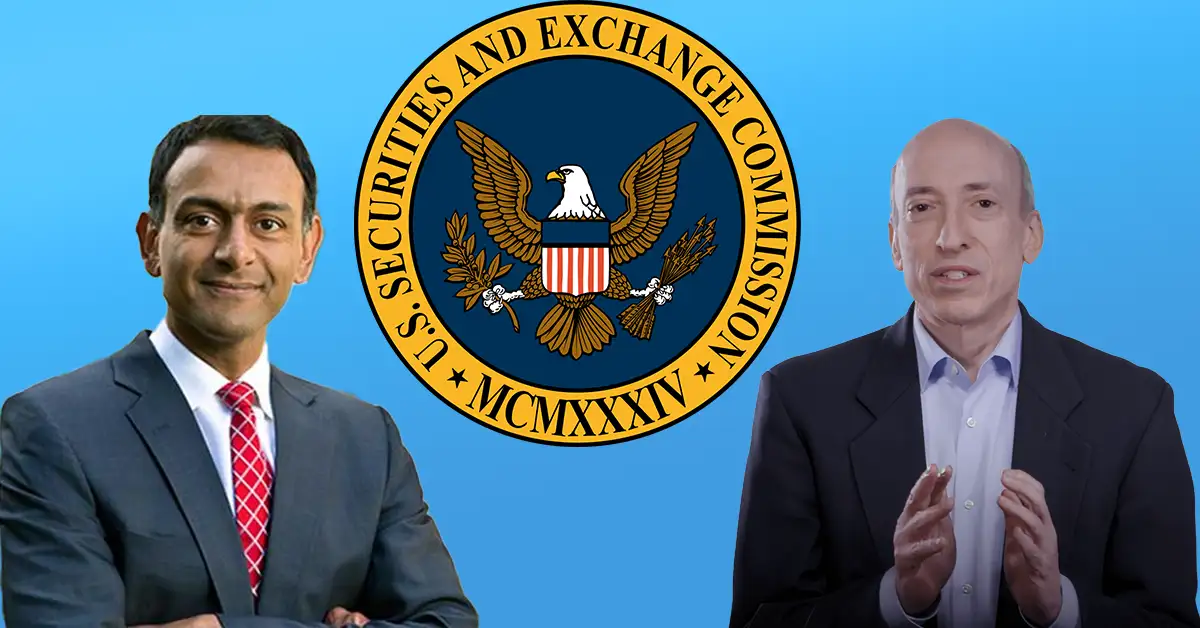

Gary Gensler’s Departure and Its Impact on the Crypto World

As Gary Gensler prepares to step down from his role as Chairman of the U.S. Securities and Exchange Commission (SEC) on January 20, 2025, he leaves behind a significant parting shot at the cryptocurrency industry. Under his leadership, the SEC has submitted an extensive 81-page document opposing Binance’s motion to dismiss an ongoing lawsuit. This document categorically identifies Binance Coin (BNB) and ten other digital tokens as securities. Let’s delve deeper into the implications for Binance and the broader cryptocurrency market.

The SEC’s Focus: Eleven Cryptocurrencies Under the Microscope

The SEC’s scrutiny extends beyond Binance Coin, as it also classifies ten additional tokens as securities: Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and COTI. However, the filing does more than merely listing these tokens; it accuses Binance of actively promoting secondary markets for these tokens. This is significant because it suggests Binance may have encouraged investors to view these tokens as viable profit-generating assets.

The SEC’s arguments are influenced by Ripple’s partial legal victory earlier this year, which determined that XRP’s secondary sales did not constitute securities. As a result, the SEC is being particularly meticulous in its current approach to avoid similar pitfalls.

Binance Under the Spotlight: Allegations and the Howey Test

The SEC’s case is fundamentally based on the Howey Test, a legal standard used to determine whether a transaction qualifies as an investment contract. This test evaluates three key aspects:

- Was there a monetary investment involved?

- Was there a shared objective among investors?

- Did investors anticipate profits primarily from the efforts of others?

According to the SEC, Binance meets all these criteria. The agency alleges that Binance linked the value of its tokens to the growth of its ecosystem, thereby leading users to perceive their actions as investments. Furthermore, the SEC contends that secondary market trades should also be considered securities, directly challenging Binance’s stance on the matter.

Exemption of Ethereum and Bitcoin: Unraveling the Rationale

The SEC’s approach has not gone unchallenged, with Paul Grewal, Coinbase’s Chief Legal Officer, questioning the consistency of the SEC’s enforcement. In a public statement, he highlighted the omission of Ethereum (ETH) and Bitcoin (BTC)—the two leading cryptocurrencies—from this filing. This selectivity raises critical questions about the SEC’s rationale, especially given the market dominance of ETH and BTC. While Ripple’s case might have influenced the SEC’s strategy, the absence of these major cryptocurrencies leaves many industry observers puzzled.

The Broader Implications for the Crypto Market

Should the SEC prevail, the repercussions could be substantial. Tokens deemed to be securities might be delisted from major platforms like Binance, subjecting developers and investors to more stringent regulations. This could potentially stifle innovation and slow growth within the industry. The SEC’s objective is to assert regulatory authority over the crypto space by addressing both token sales and secondary trading activities, thereby establishing a definitive legal framework.

Looking Ahead: The Future of Cryptocurrency Regulation

This filing represents a reinforcement of the SEC’s allegations against Binance, rather than the initiation of new legal proceedings. However, the conspicuous absence of Ethereum and Bitcoin from this narrative raises significant concerns about equitable enforcement. As Gensler’s departure looms, this move represents his final major action. For the crypto industry, the stakes are incredibly high, with the court’s decision having the potential to either bring much-needed clarity or cause considerable disruption in the market.