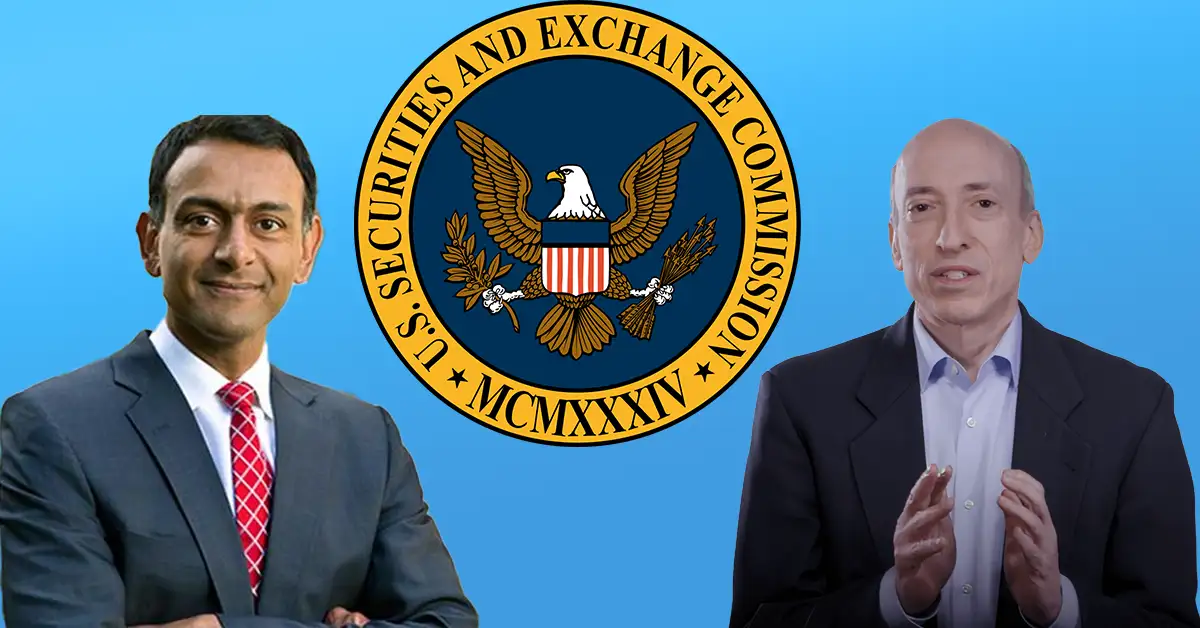

As Gary Gensler prepares to step down as the Chair of the U.S. Securities and Exchange Commission (SEC) on January 20, 2025, he leaves behind a significant impact on the cryptocurrency landscape. In his final move, the SEC has taken a decisive step against the crypto industry by filing an extensive 81-page document against Binance. This document opposes Binance’s motion to dismiss a lawsuit, arguing that Binance Coin (BNB) and ten additional tokens should be classified as securities. Let’s delve deeper into the implications for Binance and the broader cryptocurrency market.

SEC’s Target: Eleven Cryptocurrencies

The SEC has widened its scope beyond Binance Coin, designating ten more tokens as securities. These include Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and COTI. However, the SEC’s filing doesn’t stop at naming these tokens. It accuses Binance of more than merely selling them, alleging that the platform promoted secondary markets for these tokens. Why is this significant? Because it purportedly led investors to perceive these tokens as potential profit-generating assets.

The SEC’s stance is influenced by Ripple’s partial victory earlier this year. In that case, the court ruled that XRP’s secondary sales did not classify as securities, prompting the SEC to carefully address such gaps in its current approach with Binance.

How Binance is Being Called Out

The SEC’s case against Binance heavily relies on the Howey Test, a crucial benchmark in determining whether an asset qualifies as a security. The test considers three main aspects:

- Was there a monetary investment?

- Was there a common enterprise?

- Did investors expect profits primarily from the efforts of others?

The SEC contends that Binance meets all three criteria, asserting that the platform linked token values to its ecosystem’s expansion, thus encouraging users to view their involvement as an investment. Furthermore, the SEC claims that secondary market trades also fall under the category of securities, directly challenging Binance’s contrary stance.

Ethereum and Bitcoin: Why Are They Spared?

Not everyone agrees with the SEC’s approach, particularly its selective targeting. Paul Grewal, Coinbase’s Chief Legal Officer, has openly criticized what he perceives as selective enforcement. He poses a pertinent question: Why are Ethereum (ETH) and Bitcoin (BTC), the two most dominant cryptocurrencies, consistently excluded from such filings?

In a tweet, Grewal questioned the absence of ETH and BTC in the SEC’s 81-page argument, highlighting a potential inconsistency in the SEC’s logic. Despite Ripple’s case possibly influencing the SEC’s strategy, critics remain puzzled by the omission.

What This Means for Crypto

Should the SEC prevail in its case, the repercussions could be substantial. Tokens labeled as securities might be removed from platforms like Binance, subjecting developers and investors to stringent regulations that could hinder innovation and growth within the crypto sector. The SEC aims to establish control over the cryptocurrency market by targeting both token sales and secondary trades, striving to create a definitive legal framework.

What’s Next?

This filing does not introduce a new lawsuit but reaffirms the SEC’s existing claims against Binance. Yet, the exclusion of Ethereum and Bitcoin raises significant questions about the fairness and consistency of regulatory actions.

As Gensler approaches the end of his tenure, this move serves as his final substantial effort to regulate the crypto industry. For the cryptocurrency market, the stakes are extraordinarily high. The outcome of this case could either provide much-needed clarity or dramatically disrupt the current market dynamics.