The Return of ETF Hype: Canary Capital’s Innovative Approach

The excitement surrounding Exchange-Traded Funds (ETFs) is resurging, with a notable highlight being the introduction of a potential Hedera (HBAR) spot ETF by Canary Capital. This development comes in the wake of Donald Trump’s political resurgence, which has stirred significant interest in the financial markets. Canary Capital has strategically filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC), aiming to pioneer the first-ever ETF that provides direct exposure to HBAR, the native cryptocurrency of the Hedera Network.

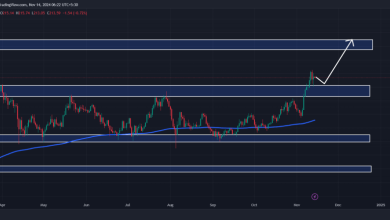

Canary Explores Buying Demand in HBAR

By submitting an S-1 registration to the SEC, Canary Capital is positioning itself to launch an ETF centered on Hedera’s HBAR token. If the SEC approves this filing, it would mark a significant milestone as the first ETF allowing investors to gain exposure to HBAR on a public exchange. The S-1 filing is a crucial step for companies seeking to offer investment products like ETFs, paving the way for investors to engage with HBAR’s value through a regulated platform, eliminating the necessity of directly purchasing or holding the token.

HBAR, the native currency of the Hedera network, operates on the Hashgraph consensus algorithm, providing a decentralized public network for swift and secure global transactions. Hedera’s governance structure involves a council of prominent companies and organizations, ensuring secure, compliant decision-making and fair token distribution. Within this ecosystem, HBAR powers decentralized applications, facilitates transactions, and supports network governance.

The proposed Canary HBAR ETF, as detailed in its S-1 filing, plans to invest solely in HBAR, avoiding derivatives, futures, or other financial instruments. While the filing does not specify a custodian or administrator, it marks a significant step forward in cryptocurrency investment opportunities.

Steven McClurg, the founder of Canary Capital and Valkyrie Funds, known for its spot crypto ETFs, previously launched an HBAR Trust in October for accredited investors. Canary Capital has also filed for other spot cryptocurrency ETFs, including those for Litecoin, Solana, and XRP, showcasing its commitment to expanding crypto investment avenues.

The Intersection of Trump, the SEC, and the Future of Crypto ETFs

The landscape of crypto ETFs in the U.S. remains unpredictable, with the SEC’s stance on approving additional spot crypto ETFs yet to be fully determined. Earlier this year, the agency approved 11 spot Bitcoin ETFs and subsequently sanctioned eight Ethereum ETFs, reflecting a cautious yet progressive approach to cryptocurrency investment products.

Speculation is rife that Gary Gensler, the current SEC Chair known for his critical stance on cryptocurrencies, may resign before the next presidential administration takes charge. President-elect Donald Trump has already hinted at plans to dismiss Gensler if he assumes office, adding another layer of intrigue to the regulatory environment.

Reports suggest that Trump’s representatives are considering potential candidates for the SEC’s top position, including Robinhood’s Chief Legal Officer, Dan Gallagher, former Republican SEC commissioner Paul Atkins, and Robert Stebbins, a former SEC general counsel. Despite these rumors, experts emphasize that Trump cannot legally remove Gensler without just cause. Although it is common for regulatory figures to step down following a political transition at the White House, there has been no indication from Gensler himself about any intention to resign.