Significant Gains for XRP

In recent days, XRP, a digital asset developed by Ripple’s payment network, has experienced substantial gains in the cryptocurrency market. Currently valued at approximately $11 billion, XRP is actively working towards mainstream acceptance by planning the launch of its own Exchange-Traded Fund (ETF). However, these ambitions are presently hindered by a protracted legal battle with the U.S. Securities and Exchange Commission (SEC), which poses a significant challenge to the ETF’s introduction.

A War Against Crypto

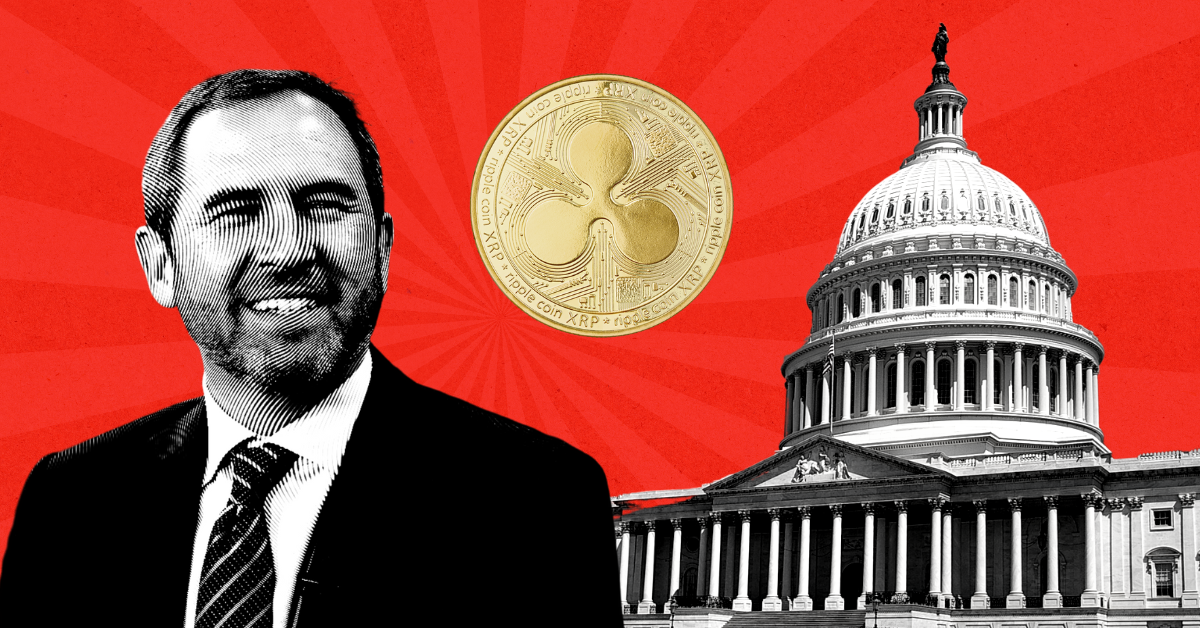

In a recent interview with the BBC, Ripple’s CEO provided insights into his strategic recommendations for the first 100 days of Trump’s potential administration. He articulated concerns regarding the current regulatory landscape, pointing out that Trump has recently positioned himself as a pro-crypto leader. One of the crucial actions Trump vowed to undertake was the dismissal of Gary Gensler, the SEC Chair, whom the CEO accuses of waging a relentless campaign against cryptocurrency innovation in the United States.

He emphasized that countries such as the United Kingdom, Singapore, and Switzerland have embraced cryptocurrency by establishing clear regulatory frameworks. This openness has facilitated entrepreneurial growth and attracted capital, fostering a thriving environment for the industry.

XRP Not A Security – The Law of the Land

The Ripple CEO shared that the company has been embroiled in a legal battle with the SEC for over three years, culminating in a significant victory last summer. The court’s ruling unequivocally stated that XRP is not a security, a decision which the SEC is appealing in part. Importantly, the SEC is not contesting the classification of XRP as a non-security, reinforcing its legal status in the United States.

Despite this clarity for XRP and Bitcoin, the broader cryptocurrency industry remains frustrated. Other major cryptocurrencies like Ethereum (ETH) and Solana face regulatory uncertainties. The CEO described the current situation as ‘maddening,’ highlighting the inefficiency of litigating each token individually. He called for the SEC to establish definitive regulatory guidelines, similar to the comprehensive taxonomies in the UK and Japan.

What is the Key Change Brad Expects?

The CEO outlined a critical shift he anticipates: the SEC’s stance under Gensler’s leadership, which has categorized most cryptocurrencies as securities, needs reevaluation. He clarified the distinction between traditional securities, which represent ownership rights in a company, and cryptocurrencies, which do not confer such ownership. The CEO emphasized the necessity for regulatory clarity, asserting that the SEC should not assume overarching control over the crypto sector.

Additionally, he criticized the regulatory approach of enforcement without clear legislative guidelines, urging the SEC to focus on developing explicit and coherent regulatory frameworks. This, he argued, would provide the necessary clarity and stability for the industry to flourish.