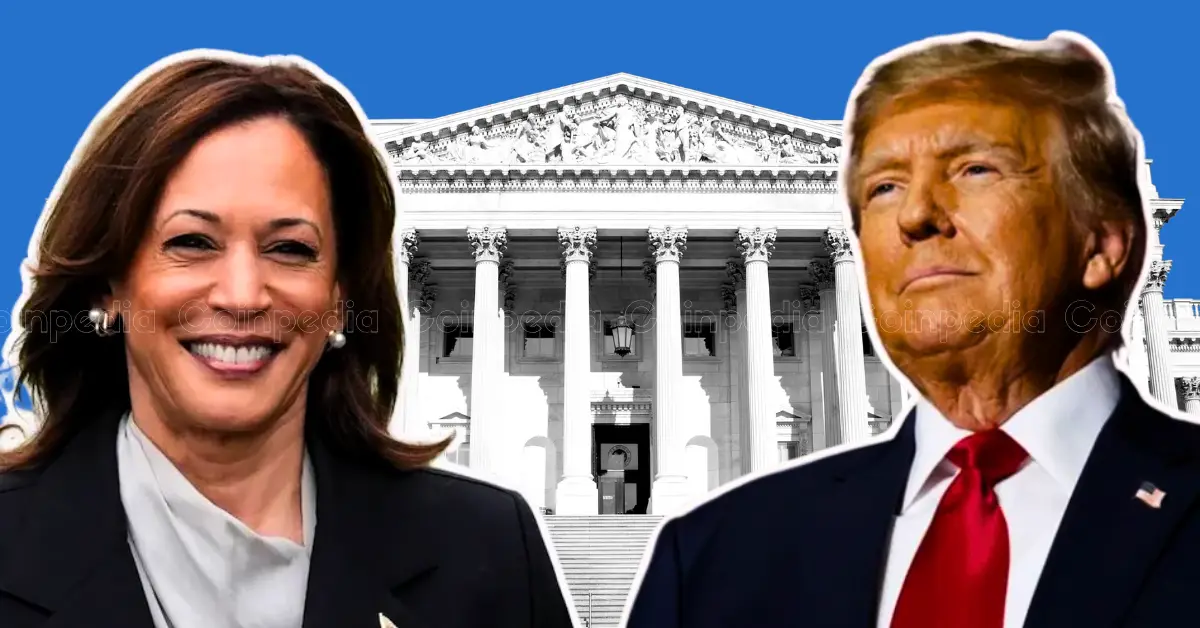

As the United States approaches one of its most eagerly awaited elections, Bitcoin has once again crossed the $70,000 threshold. This marks a 2.4% increase in the past 24 hours, fueled by a wave of excitement and speculation surrounding the election’s potential outcomes. In the political arena, Donald Trump is currently leading the polls with a 62.9% chance of victory over Kamala Harris, who holds a 37.2% likelihood.

Crypto-Linked Stocks Also Rise

The enthusiasm in the crypto market has also extended to crypto-linked stocks, which are experiencing upward trends. MicroStrategy (MSTR) has seen an increase of 7.5% in early trading. Semler Scientific reported its Q3 results and noted a substantial 26% rise as it revealed additional Bitcoin acquisitions and reaffirmed its commitment to a Bitcoin stockpiling strategy akin to that of Michael Saylor’s MicroStrategy.

Bitcoin mining companies, which have recently faced challenges, are also witnessing gains. Marathon Digital (MARA), Riot Platforms (RIOT), and Hut 8 (HUT) recorded increases ranging from 3% to 5%. Coinbase (COIN) saw a 3% rise, although it remains about 10% lower following a disappointing Q3 earnings report.

In traditional financial markets, the Nasdaq saw an increase of more than 1%, while the S&P 500 advanced by 0.8%. Both gold and oil prices were on the rise, and the 10-year U.S. treasury yield increased by seven basis points to 4.36%.

Polymarket Again Shows Increased Odds For Trump

After experiencing significant volatility in recent days, Polymarket is once again indicating higher odds for a Trump victory, currently standing at 62% compared to a 38% chance for Kamala Harris. The possibility of a Republican sweep, encompassing the presidency, the House, and the Senate, is at 39%, while the odds of a Democrat sweep are at 16%.

This surge in Bitcoin’s price is closely tied to the potential for a Trump win, as many investors and community members believe his policies could foster long-term growth in the crypto market and eliminate regulatory barriers. Trump’s lead in the polls has instilled confidence among conservative investors, further driving Bitcoin’s price upward.

Market analysts are predicting a possible 10% price movement in either direction. If the price moves upward, investors might witness a new all-time high for Bitcoin, surpassing the $75,000 mark. Additionally, the Relative Strength Index (RSI) is trending upwards, signaling a bullish momentum in the market.