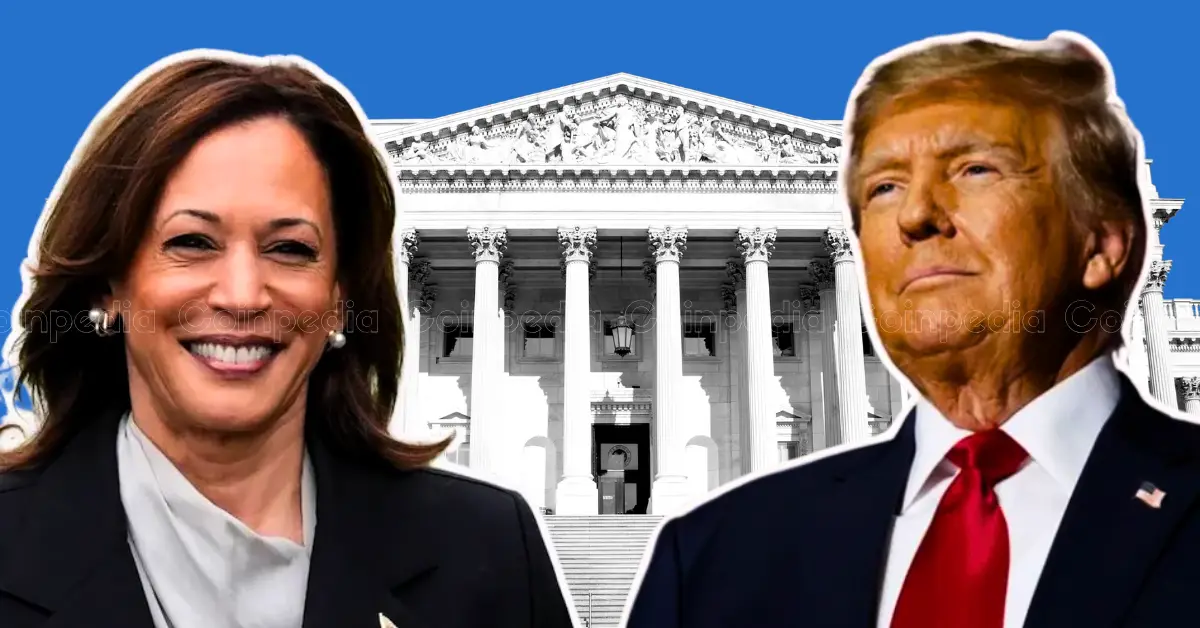

As the United States approaches one of its most eagerly awaited elections, Bitcoin has once again surged to the $70,000 milestone. This represents a 2.4% increase in the past 24 hours, fueled by a wave of excitement and speculation surrounding the election’s outcome. In the political arena, Donald Trump is currently leading the polls with a 62.9% likelihood of victory, compared to Kamala Harris at 37.2%.

Crypto-Linked Stocks on the Rise

Crypto-related stocks have also experienced an upward trajectory, reflecting the broader market enthusiasm. For instance, MicroStrategy (MSTR) saw a notable 7.5% increase in early trading. Semler Scientific, which recently released its Q3 results, recorded a substantial 26% rise, attributed to additional Bitcoin purchases and a reaffirmation of its commitment to a Bitcoin stockpiling strategy akin to that of Michael Saylor’s MicroStrategy.

The landscape for Bitcoin miners, such as Marathon Digital (MARA), Riot Platforms (RIOT), and Hut 8 (HUT), has also improved, with gains ranging from 3% to 5%. Meanwhile, Coinbase (COIN) experienced a 3% uptick, although it remains about 10% lower over recent sessions due to a lackluster Q3 earnings report.

Traditional markets have similarly shown positive movements, with the Nasdaq climbing over 1% and the S&P 500 advancing by 0.8%. Commodities like gold and oil have also been in the green, and the 10-year U.S. Treasury yield increased by seven basis points to 4.36%.

Polymarket Indicates Stronger Odds for Trump

Following a period of volatility, Polymarket is once again reflecting increased odds for a Trump victory, currently standing at 62% compared to a 38% chance for Kamala Harris. The probability of a Republican sweep, encompassing the presidency, the House, and the Senate, is at 39%, whereas the chance of a Democratic sweep is 16%.

The recent surge in Bitcoin’s price is closely tied to the potential of a Trump win. Many investors and community members believe that his policies could foster long-term growth in the cryptocurrency market and help address regulatory challenges. Trump’s lead in the polls has bolstered confidence among conservative investors, further driving up Bitcoin’s value.

Market analysts predict a potential 10% movement in either direction. If the price trends upward, investors might witness a new all-time high for Bitcoin, surpassing the $75,000 mark. Additionally, the Relative Strength Index (RSI) is trending upward, suggesting bullish momentum in the market.

In summary, the upcoming U.S. elections are not only pivotal in shaping the political landscape but also significantly influencing the financial markets, particularly cryptocurrencies and related stocks. As the election day approaches, investors and market participants will be closely monitoring developments, poised to adjust their strategies in response to the evolving dynamics.