The United States Securities and Exchange Commission (SEC) has revealed its enforcement results for the fiscal year 2024, showcasing a historic milestone. In a recent press release, the SEC disclosed that it filed a total of 583 enforcement actions and secured orders amounting to $8.2 billion in financial remedies, marking the highest financial recovery in the SEC’s history.

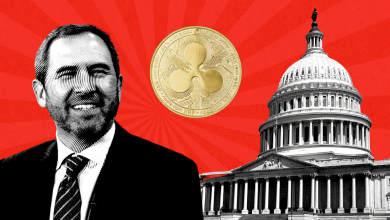

“Not A Measure of Success,” Critiques Ripple CLO

Despite the SEC’s announcement of record-high financial recoveries, Ripple’s Chief Legal Officer (CLO), Stuart Alderoty, has been vocal about his disapproval. Alderoty criticized the SEC for its apparent pride in enforcement actions and hefty fines, comparing it to a professor boasting about the highest failure rate in their class or the most cheating scandals. He emphasized that such achievements should not be considered a measure of success but rather a sign of oversight failures driven by misguided incentives.

Alderoty argued that the SEC’s approach in legal proceedings has fallen short of providing the crypto community with the necessary clarity on rules and regulations. This criticism highlights the ongoing tension between regulatory bodies and the evolving digital asset industry.

SEC Praises Enforcement Division’s Role

In contrast to the criticism, the SEC commended the Division of Enforcement’s efforts under the leadership of Chair Gary Gensler. Gensler stated, “The Division of Enforcement is a steadfast cop on the beat, following the facts and the law wherever they lead to hold wrongdoers accountable.” He further noted that the division plays a crucial role in upholding the integrity of capital markets for the benefit of both investors and issuers.

Despite these praises, Gensler faces growing criticism from investors and industry experts who argue that his tenure has been detrimental to investor interests. As the political landscape shifts, with former President Trump potentially returning to office, the crypto community remains hopeful for more transparent regulations, given Trump’s pro-crypto stance.

Ripple Unveils $3.8 Billion Tokenization Plan on XRPL

In a groundbreaking move, Ripple has announced the launch of a $3.8 billion tokenized money market fund on the XRP Ledger (XRPL). This strategic initiative, in collaboration with Archax and global investment firm ABRDN, marks the first-ever tokenized money market fund on the XRP Ledger. This development underscores XRPL’s potential to transform capital markets by leveraging blockchain technology to enhance infrastructure deployment.

Momentum Building for XRP ETF Launches

The excitement surrounding exchange-traded funds (ETFs) is extending beyond Bitcoin, as XRP emerges as a prospective contender in the ETF arena. Global ETF provider WisdomTree recently filed to launch an XRP ETF in the United States, marking the third such filing following Bitwise and Canary Capital. This growing interest signifies the potential for XRP to become a major player in the ETF market, reflecting the evolving landscape of digital asset investments.