In recent days, XRP, the cryptocurrency developed by Ripple, has experienced significant gains. With a current market valuation of approximately $11 billion, Ripple is ambitiously pushing to achieve mainstream adoption by launching its own exchange-traded fund (ETF). However, this effort is hindered by an ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), which poses a substantial obstacle to the ETF launch.

A War Against Crypto

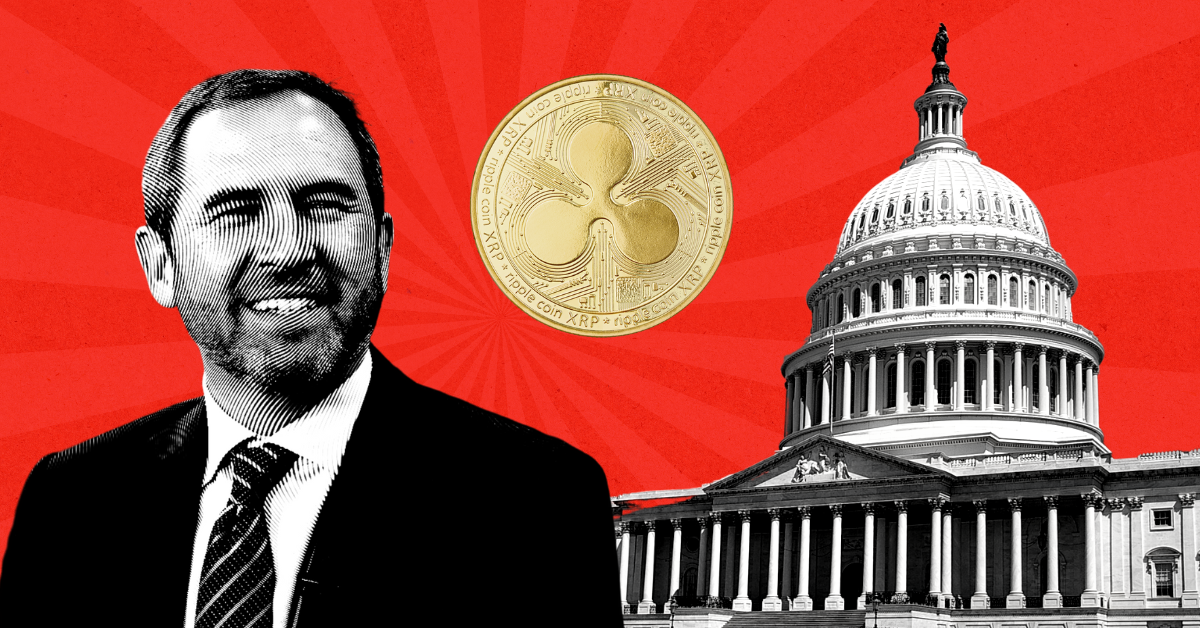

In a recent interview with the BBC, Ripple CEO Brad Garlinghouse shared insights into his crypto-related expectations for the Trump administration’s initial 100 days. When asked about the primary issues he wants the former President to address, Garlinghouse pointed out Trump’s recent self-proclamation as a “crypto President” and his advocacy for the cryptocurrency industry. One of the key promises made by Trump was to dismiss Gary Gensler, the SEC Chair, whom Garlinghouse accuses of spearheading a regulatory war against crypto in the United States.

Garlinghouse emphasized that countries like the United Kingdom, Singapore, and Switzerland have embraced cryptocurrency, establishing clearer regulatory frameworks. This clarity has allowed entrepreneurs and capital to flow more freely, fostering industry growth and innovation. The U.S., he argues, should follow suit by adopting similar measures to support the crypto ecosystem.

XRP Not A Security: The Law of the Land

Garlinghouse revealed that Ripple has been embroiled in a legal dispute with the SEC for over three years, achieving a significant victory last summer. The presiding judge clearly stated that XRP, by itself, is not a security. Although the SEC is appealing parts of the decision, they are not contesting the ruling that XRP is not a security. This victory provides Ripple with confidence, as it establishes the legal status of XRP in the United States.

However, Garlinghouse expressed frustration over the lack of regulatory clarity for other cryptocurrencies. While Bitcoin and XRP have explicit regulatory definitions, leading cryptocurrencies like Ethereum (ETH) and Solana face ongoing challenges. He described the situation as “maddening,” as each token’s legal status is litigated individually. Garlinghouse advocates for clear regulatory guidelines, similar to those established in the UK and Japan, to streamline compliance for the U.S. crypto industry.

What is The Key Change Brad Expects?

Garlinghouse identified a crucial change needed in the SEC’s approach under Gensler’s leadership. He noted that the SEC has attempted to classify most cryptocurrencies as securities. Securities typically involve ownership rights in a company, which is not applicable to cryptocurrencies. For instance, owning Apple securities equates to holding a stake in the company, a concept not mirrored in crypto ownership.

Garlinghouse argued that the SEC should not “own” the cryptocurrency industry through its regulatory efforts. Instead, he urged the agency to move beyond enforcement-based regulation and invest time in developing clear, comprehensive rules. This approach would provide the industry’s stakeholders with well-defined guidelines to follow, fostering innovation while ensuring compliance.

In conclusion, as Ripple navigates its legal challenges and seeks to expand XRP’s mainstream adoption, the need for regulatory clarity in the cryptocurrency space becomes increasingly crucial. With ongoing discussions and evolving policies, the future of XRP and the broader crypto industry remains a topic of significant interest and potential.