The cryptocurrency market is experiencing a significant surge, driven by the triumph of pro-crypto candidates in the United States Senate, House of Representatives, and the Presidency. This political shift has infused the market with bullish energy, particularly for Bitcoin (BTC). The new administration’s favorable stance towards digital currencies is reshaping the market dynamics and boosting investor confidence.

Current Market Overview

In the past 24 hours, the total cryptocurrency market capitalization has increased by approximately 2.2%, reaching around $2.66 trillion as of Thursday, November 7, during the early Asian trading session. This growth is largely attributed to the anticipation surrounding the Federal Open Market Committee (FOMC) data release. Earlier today, Bitcoin reached a new all-time high of approximately $76,243, before slightly retracting to $75,386 at the time of this report.

Analyst Targets for Bitcoin in the Coming Months

According to Ali Charts, a prominent analyst, Bitcoin’s price trajectory often follows a historical pattern. Typically, Bitcoin peaks about 8 to 12 months after surpassing its previous all-time high on a monthly closing basis. If this pattern continues, we could witness Bitcoin reaching a new significant peak between July and November 2025. This trend indicates a potential period of sustained growth, which could be highly beneficial for investors and traders.

Renowned trader Peter Brandt predicts an explosive rally for Bitcoin, suggesting that the price could soar to a cycle top between $130k and $150k by August or September. Furthermore, the Relative Strength Index (RSI) on both weekly and monthly charts appears poised to exceed the 70 level, signaling that bullish momentum is firmly in control.

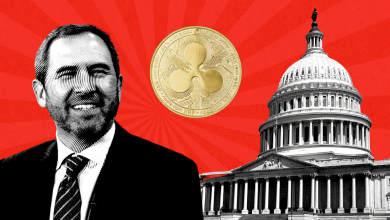

The Dawn of a New Era for Cryptocurrency

According to Matt Hougan, Chief Investment Officer at Bitwise, the crypto market is entering what he describes as a ‘golden age.’ This era is expected to be marked by increased cash inflows, wider adoption, and a robust bull market that could last for years. A key indicator of this shift is the anticipated establishment of a strategic Bitcoin reserve in the United States, projected to comprise 1 million coins. This move could symbolize the integration of Bitcoin into the mainstream financial framework, further solidifying its position as a valuable asset class.

Conclusion

The political and economic landscape in the United States is proving to be a fertile ground for the growth of cryptocurrencies, particularly Bitcoin. The alignment of pro-crypto policies and market dynamics suggests a promising future for digital assets. As the market continues to evolve, investors and enthusiasts alike are eagerly watching for the next milestones in Bitcoin’s journey.