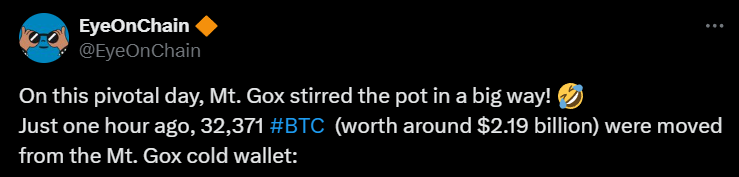

Bitcoin (BTC), known as the world’s leading cryptocurrency by market capitalization, recently experienced a dip below the $68,000 threshold. This decline coincided with Mt. Gox, the now-defunct cryptocurrency exchange, executing a massive transfer of billions in BTC. On November 5, 2024, the Whales transaction tracker shared a noteworthy update on X (formerly Twitter), revealing that Mt. Gox had shifted an impressive 32,371 BTC, valued at approximately $2.19 billion, from its cold storage.

Mt. Gox’s Billion-Dollar BTC Transfers

This substantial BTC transaction took place on a critical day in the United States, coinciding with the presidential election. Data provided by Whale Tracker indicated that 30,371 BTC was transferred to the wallet address “1FG2Cv.” As of now, there have been no further movements or transfers from this address, raising questions and speculation within the cryptocurrency community.

In addition to this, 2,000 BTC were allocated to the cold wallet “1jbezD,” and another 2,000 BTC were moved from Mt. Gox to the wallet address “15gNRV.” Despite these massive Bitcoin transfers, the asset’s price showed resilience after dipping below the $68,000 mark. Subsequently, BTC found support at the 200 Exponential Moving Average (EMA) on the four-hour chart and has since been trending upwards.

In-Depth Bitcoin Price Analysis

Currently, Bitcoin is trading at approximately $68,150, reflecting a 1.35% decrease in value over the past 24 hours. Interestingly, during this same timeframe, Bitcoin’s trading volume surged by 26%. This uptick in trading activity suggests heightened engagement from traders and investors, likely influenced by the looming U.S. election.

Comprehensive Bitcoin Technical Analysis and Future Projections

According to seasoned technical analysts, Bitcoin’s stance appears neutral as it hovers near a critical support level within the breakout zone, bolstered by the 200 EMA. The rationale behind Mt. Gox’s significant BTC movement remains unclear, fueling speculation about its potential impact on Bitcoin’s price. Nevertheless, it appears the transaction might not have directly influenced the price dynamics.

Looking at recent price movements, if Bitcoin manages to close a four-hour candle above the $69,000 mark, there is a strong possibility of substantial price appreciation in the days ahead. In the volatile cryptocurrency sector, the activity of whales and investors is noteworthy, with large BTC transactions surging by 90% in the last 24 hours. These significant transactions underscore increased participation, even amid a price pullback, which could be interpreted as a bullish signal.

As the cryptocurrency landscape continues to evolve, these developments underscore the ever-present volatility and the potential for rapid changes in market sentiment. Investors and traders should remain vigilant, closely monitoring both technical indicators and market news to navigate this dynamic environment effectively.